georgia property tax exemption codes

The California sales tax rate is currently. New signed into law May 2018.

Exemptions To Property Taxes Pickens County Georgia Government

To review the rules in.

. As of March 2016 total sales tax rates in Georgia are 3 for groceries and 7. Affidavit Energy Code Blower Door Compliance. To 500 pm Monday-Friday.

The Georgia state sales tax rate is currently. In addition some states adopted legislation in 2020 that changed various individual income tax provisions and made those changes retroactive to the beginning of tax year 2020. Idaho State Tax Commission New Idaho law allows property tax exemption for 100000 in personal.

You must be legally married and complete married filings for your taxes. The 2018 United States Supreme Court decision in South Dakota v. 1266 E Church Street Suite 121 Jasper GA 30143.

However applications must be filed by April 1 in order to obtain the exemption for the current year. Public Property Records provide information on homes land or commercial properties including titles mortgages property. More about the New Jersey Individual Tax Instructions Individual Income Tax TY 2021 If you need to file Form NJ-1040 reference this booklet to help you fill out and file your taxes.

June 1st to November. Property exempted by OCGA. The tax rate was raised from 6 on April 1 2008 to offset the loss of revenue from the statewide property tax reform which is expected to significantly lower property taxes.

Tax exemption rules have some strict exceptions that you need to understand. Businesses that are comparing. You may contact us at 317 232-2240 with specific tax exemption questions.

All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold 30 of the gross US-source FDAP payments such as dividends. Furthermore economic nexus may be triggered. Has impacted many state nexus laws and sales tax collection requirements.

Almost every state that levies an income tax allows some form of income tax exemption or credit for citizens over age 65 that is unavailable to non-elderly taxpayers. Public safety first responders are given a TAVT exemption up to 50000. Property Tax Exemption Property Exempt from Taxation.

Individual Tax Instructions requires you to list multiple forms of income such as wages interest or alimony. State governments provide a wide array of tax breaks for their elderly residents. 98 Unemployment Insurance Tax.

Chatham County makes every effort to assure that the information presented on these web pages are up to date but to obtain the most accurate information you should verify this information with the individual municipality. Ad valorem means according to value We bill for annual property taxes near the middle of September. The Tax Assessors are responsible for determining the tax digest which is the value of taxable property in Macon County and the amount of taxes due according to the state tax code.

Georgia u 100 0. Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses. Taxation being the rule and exemption the exception.

Statewide sales and use tax exemption for clothing and footwear. 7 state sales tax. Section 48-5-41 must not be used for private or.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income. The County sales tax rate is. Tax management for vacation rental property owners and managers.

Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. You provide the merchant with the ST-105 for their records. The average sales tax rate of all Georgia zip codes is 7083.

Abolition of property qualifications for white men from 1792 New Hampshire to 1856 North Carolina during the periods of Jeffersonian and Jacksonian democracy. The Use Test and the Home Sale Tax Exemption. Local governments adopt their millage rates at various times during the year.

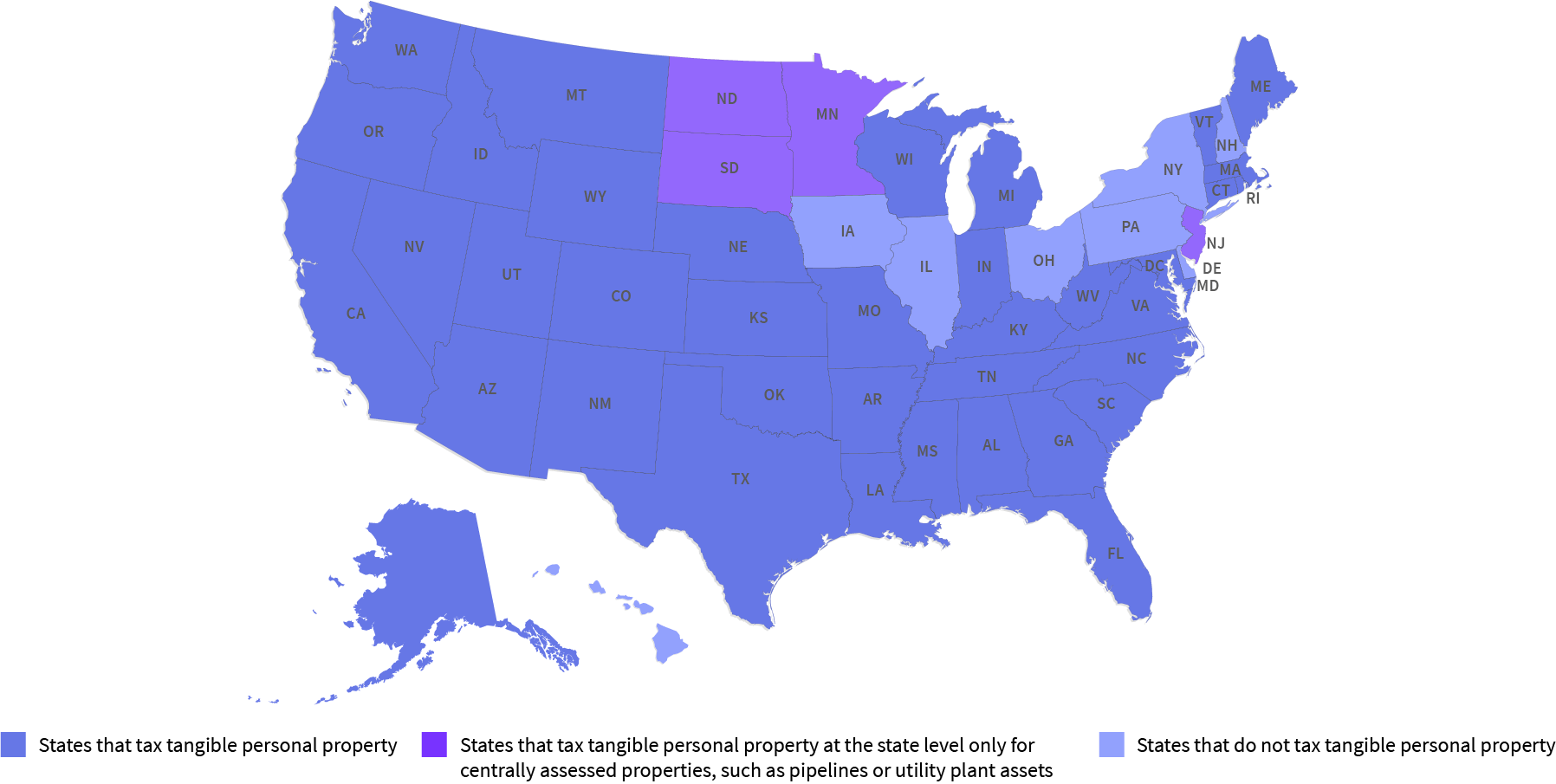

The property tax base is an important element of state and local tax codes as property taxes alter business investment decisions and where people decide to live. The minimum combined 2022 sales tax rate for Sacramento California is. The Fulton County sales tax rate is.

DeKalb County Property Records are real estate documents that contain information related to real property in DeKalb County Georgia. 144 Property Tax. The millage rates below are those in effect as of September 1.

The Tax Assessors appraise property at fair market value mail assessment notices annually maintain tax records and maps and inspect mobile homes for updated decals. The ad valorem tax more commonly called property tax is the primary source of revenue for local governments in Georgia. Unfortunately too many of these breaks are poorly.

Applications filed after April 1 will result in the exemption being applied the next year. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Click here or call 706-253-8700 for Property Tax information at Pickens County Georgia government.

This is the total of state county and city sales tax rates. The Georgia GA state sales tax rate is currently 4. Several states changed key features of their individual income tax codes going into tax year 2021.

The exemption of WHT applies if the beneficial owner of the dividend is a company that holds directly or indirectly at least 50 of the share capital of the distributing company and has invested at least EUR 3 million or equivalent amount in Georgian currency in the share capital of the latter at the date of effective payment of the. In addition you must have been the owner of the property and live on the property on January 1 of the year you are making application. The Board of Tax Assessors sets your Homestead Exemption status.

Depending on local municipalities the total tax rate can be as high as 9. See also Georgia Department of Revenue Freeport Exemption https. Look up 2022 sales tax rates for Atlanta Georgia and surrounding areas.

209 Corporate Tax. The following departments collaborate to. The Tax Commissioners Office is open from 900 am.

ZIP codes associated with atlanta. The Sacramento sales tax rate is. If you are buying items that qualify for a sales-tax exemption you can fill out Form ST-105.

All property is taxable unless an exemption has been provided by law. This improves the explanatory power of the State Business Tax Climate Index as a whole because components with higher standard deviations are those areas of tax law where some states have significant competitive advantages. The 500000 tax break will not be taxable income as long as you file a joint return in the same year you purchase your new home.

The primary mission of the Leon County Property Appraisers Office is to locate identify and appraise all property subject to ad valorem taxes produce and maintain an equitable tax roll and administer all property tax exemptions in accordance with Florida Statutes and the Rules and Regulations of the Florida Department of Revenue. Most states also provide special property tax breaks to the elderly. Tax rates are provided by Avalara and updated monthly.

However tax-paying qualifications remained in five states in 1860Massachusetts Rhode Island Pennsylvania Delaware and North Carolina.

Self Directed Ira Vs Solo 401k Which Is Best For Real Estate Investors Real Estate Investor 401k Investment Services

Personal Property Tax Portsmouth Va

2022 Property Taxes By State Report Propertyshark

New Resident Cobb Taxes Cobb County Tax Commissioner

Comparing The Cost Of Owning And Operating Commercial Real Estate Across The United States Corelogic

Understanding Appealing Fulton County Property Tax Assessment Workshop Youtube

Ultimate Guide To Understanding South Carolina Property Taxes